The recent embrace of the Ambani brothers has raised the spectre of a media empire that will eclipse everything else. A peek into the not-so-distant future

Last year, Rupert Murdoch, the chairman and CEO of the $34-billion News Corporation and an undisputed global media czar, urged investors not to “judge us the way you would a conventional company”. He added that News Corp’s corporate culture was different as it knew that business models that work today might become obsolete tomorrow. Hence, “we are always investing in the next generation – especially when our established models are doing well”.

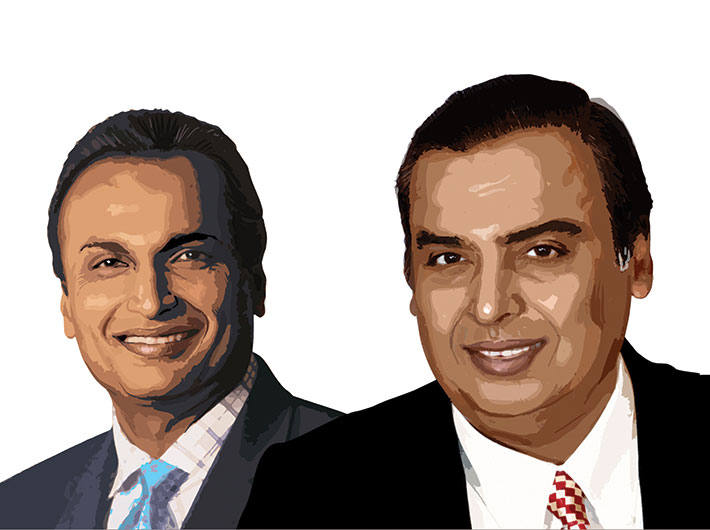

Such statements could have easily been echoed by either Mukesh Ambani or his younger brother, Anil. Over the past eight years, ever since they split in 2005 after a no-holds-barred public fight, the two siblings have slowly, although separately, thought and acted like Murdoch. They have done in India, what the controversial media baron has achieved in markets as diverse as the US, UK, Asia, Australia and Latin America. In some ways, the Ambanis are better off than Murdoch.

After years of acrimony, now that the Ambanis have taken the first baby steps to partner with each other, they can emerge as the unchallenged media czars in India. If Mukesh and Anil get their act together, as they are more likely to do in telecom and media, they can overwhelm a Bennett, Coleman & Company, which is present across platforms (print, TV, digital). They can mercilessly overpower the dominance of a Zee Group, which is integrated vertically in TV (as a broadcaster and distributor).

Recently, the two hitherto-estranged brothers inked a deal that allowed Mukesh to use 1,20,000 km of the optic fibre network, owned by Anil, to launch the former’s 4G/broadband services. They indicated that this was the beginning of more such agreements, whereby both could use their combined telecom infrastructure (telecom towers and additional fibre pipes) to deliver news and entertainment content. Analysts shouted with glee that this was a win-win partnership.

But, if the brothers also agree to share content and other distribution platforms (digital and direct-to-home) in the near future, their Indian business model will be akin to Murdoch’s international one. In fact, given the lack of regulations and restrictions on cross-media ownership in India, contrary to the situation in the US and Europe, the Ambanis’ blueprint will be more expansive and dominant. Together, they can do what Murdoch has only dreamt about, tried, and failed.

Ambanis & Murdoch: Shared vision in content

Browse through the 2012 annual report of News Corp and you will get a sense of Murdoch’s vision and global presence. He is one of the largest generators and acquirers of content, be it news, sports and entertainment. He owns TV and cable channels (the famed Fox bouquet of news, business and entertainment channels in the US, and the Star network in India); produces, co-produces and buys movies and TV serials; and has telecast rights to sporting events (National Football League and Major League Basketball). This content is beamed across countries and geographies such as India, Greater China, South East Asia, Middle East, Africa, the UK, Europe and North America.

His reach in print media is unprecedented. He owns the Wall Street Journal, Barron’s and the New York Post, apart from dozens of other publications in the US. His print properties in the UK include The Times, The Sunday Times, and The Sun. Of course, in Australia, his native country – Murdoch is now a US citizen – he manages 140 “national, metropolitan, suburban, regional and Sunday titles”. And one cannot forget his control over HarperCollins, the publishing house.

Indirectly, both the Ambani brothers have access to news content. Through a trust, Mukesh has given a huge personal loan to Raghav Bahl, who is the promoter of Network18 Group that owns TV news channels (CNN IBN and CNBC TV 18) and websites (moneycontrol.com and firstpost.com). The money that Bahl owes can be converted into equity at a later date, which will give the Mukesh-controlled trust a stake in Bahl’s privately-held firm which, in turn, owns Network18.

One has heard rumours that the elder brother has benami stakes in at least two Hindi news channels. Through his financial services arm, Reliance Capital, Anil has a stake in Bloomberg India (business news channel) and a minor one in TV Today (Aaj Tak and Headlines Today). In the past, he has had ‘influential’ holdings in TV Today and Network18. So, there is no reason to disbelieve that Anil can get into the news segment quite quickly through the several mutual funds launched by Reliance Capital.

The Ambani siblings also have several fingers in the movie and entertainment pie. Anil has official tie-ups with several Hollywood’s famous director/producers, including Steven Spielberg, to produce movies and the US-based CBS Group to air TV channels in India. Mukesh has sold regional channels, owned by the Andhra Pradesh-based Eenadu Group to Network18, where he has an indirect control. Through benami deals, the elder brother also owns other Hindi entertainment channels. His wife, Nita, manages Mumbai Indians, a leading cricket franchise in the Indian Premier League (IPL).

Ambanis & Murdoch: Ownership over distribution

Having content to sell is one part of the game. The other is to control distribution to deliver them into the customer’s living rooms and bedrooms. In this regard, News Corp, through holdings Britain’s BskyB, Italy’s Sky Italia and India’s Tata Sky, beams news and non-news programmes into the viewers’ homes. In the US, it shares and leases cable and terrestrial networks to achieve the same objective. Content is also delivered through third party-owned digital platforms like Amazon.com.

The Ambanis have a similar distribution model. Anil owns a direct-to-home (DTH) network to beam its and others’ content. In mid-2010, Anil’s Reliance Communications announced an all-stock deal to buy a controlling stake in Digicable, one of the largest cable distribution companies. Reports indicate that Mukesh has an undeclared holding in another cable distribution firm. Through Big Cinemas, Anil is one of the largest distributors and exhibitors of movies in the organised segment.

Ambanis & Murdoch: Crucial differences

While both the Ambani brothers and Murdoch make their news and entertainment content available in digital format, the former are one step ahead of Murdoch. Anil’s group includes a gaming website, social network one and a digital marketing website. Murdoch’s experiment in this arena through his purchase of myspace.com didn’t succeed, and his internet operations today amount to high-profile websites of his newspapers in the US and UK. But the US media tycoon can always acquire new sites.

Another difference between the two is that Anil’s media bouquet includes FM radio stations. The website of Reliance Broadcast Network claims that 92.7 Big FM is present “across 45 cities, 1,200 towns and 52,000+ villages” with a weekly reach of over 40 million Indians. In 2008, the group announced plans to launch similar radio channels in Singapore, the US, UK and Middle East. Although Murdoch lacks this content avenue, he owns dozens of local (mostly city-based) TV stations in the US.

However, the crucial and the most significant difference between the Ambanis and Murdoch is the former’s entry into telecom services. Between Mukesh and Anil, they will offer 2G, 3G, 4G/broadband and, as mobile becomes an important platform to download news and non-news content, they will surpass Murdoch’s vision in terms of distribution and delivery. Explains a source in Mukesh’s camp, “After we expand in 4G, we will be in an ideal position to offer value-added services as Indians are likely to watch music, movies, games and news on their smartphones.”

Telecom may turn out to be a game-changer, and enable the Ambanis to be several steps ahead of Murdoch and other Indian competitors. Already, Anil’s Reliance Communications has over 160 million mobile subscribers. Locally, the competition can come from telecom majors (Airtel), who can tie up with content providers. But the restrictions on sharing of 3G network has curtailed Airtel’s ambitions to offer value content, and given a fillip to Reliance’s 4G, which aims to do the same.

Ambani & Murdoch: Regulatory failure versus regulatory hijack

In the US, strict laws on cross-media ownership have stalled or delayed several moves made by Murdoch. For example, one of those rules stipulates that in the same localised market, TV channels in the top four viewership slots as per Nielsen ratings cannot own a newspaper among the top 20. In 1993, after he threatened to close down his New York-based tabloid, New York Post, he got a permanent waiver to own both the tabloid and the local TV station, WNYW.

Today, he is fighting a similar battle as he wishes to buy the prominent newspaper, Los Angeles Times, although he owns two Los Angeles-based TV stations, KTTV and KCOP, of which the latter shuttles between No. 4 and 5 among local stations. It is because of such compulsions, among others, that Murdoch decided to separate publishing businesses from TV ones. According to an analyst quoted in the New York Times, “If their TV stations are going to be spun off from the larger conglomerate, then… they won’t directly own newspapers and stations in those particular markets anymore.”

Similarly, after the controversial phone-hacking incident in the UK, when Murdoch’s tabloid, News of the World, was alleged to have hacked mobiles and bribed officials to get exclusives, News Corp’s plans have suffered a huge setback. One of them was the company’s inability to acquire a majority stake in BskyB. Murdoch has had to constantly change, and dilute, his business strategies in other nations such as China and India because of the fear among policymakers about his overarching powers.

Media theorists dub the above cases as ‘regulatory failure’. It is a scenario where the regulators are unable to cope with the ever- and fast-changing media models, and are forced to take action after, or when, the media owners have initiated actions. This, as is the case with Murdoch, could result in refusal to mergers and acquisitions, denial to purchase of higher stakes in cross-media entities, and/or directly and indirectly force existing media conglomerates to break up.

As opposed to ‘regulatory failure’, what we have witnessed in India is ‘regulatory hijack’. The latter happens when the regulators are weak and don’t have legal teeth to enforce their decisions. The process is aided by pliable policymakers, who are only too willing to bend over backwards to accommodate corporate interests. And the judicial bodies are unable to understand the implications of the technical issues unless it is too late or irrelevant.

This happened in telecom; in 2002, before the split, the Ambanis entered the sector through the back door. Once their CDMA operations were legitimised in 2003, they changed tracks. Post-split, in 2007, Anil convinced the policymakers to allow him entry into GSM. Although the norms in 2G said that licensors could not sell their stakes for a specific period, no such rules were imposed in 4G/broadband. So, the day a little-known entity, Infotel, got a pan-India 4G licence through e-auction, it sold a majority stake to Mukesh, who found his way back into his dream sector, telecom.

In the case of Anil, neither the regulators nor the relevant ministries attempted to stall his ownership over content and delivery platforms. Well, the same is true for his competitors in telecom and TV, but they may not have the requisite mindset to virtually capture a sector, as the Ambanis did with petrochemicals, refining and polyester fibre in the 1980s and 1990s. Big is beautiful in the Ambani rulebook, and if it is at the expense of others, so much the better.

Concludes someone who is close to the Ambani family: “In the early 2000s, Mukesh visualised the synergies between telecom and media. But he lost the telecom firm to Anil in 2005. If the two Ambani brothers can now combine Mukesh’s vision and Anil’s media assets (content and distribution), they can easily become India’s, or even Asia’s, Murdoch.”