The environment is important for everything in our lives, whether at home, in school, or any other place of work and engagement. After all, given the concerns the planet is witnessing, finding solutions is becoming tougher. In India right now, as in any other part of the world, even though there is enough conversation around environment and sustainability, breaking the way of doing things is not easy. Even more difficult is to find the money that can facilitate this change. But without this, any target for climate control and a greener India is an uphill task, on a positive note, and an impossible pipe dream otherwise.

Financing is needed for the dream to become a reality.

It can be argued that as the climate clock ticks constantly, a quiet revolution is changing the world of finance. ESG, short for environmental, social, and governance, is no longer a fancy word found in lectures and brochures. It is becoming an important area through which capital is assigned, risks are measured, and long-term value can be assessed.

In India, the conversation around sustainable finance is gaining momentum for good reason. With its population and economy expanding rapidly, the country’s energy needs are expected to triple by 2070, according to international estimates. This surge in demand comes with a critical message—growth must not compromise our home, the planet. ESG investing offers a possible channel, a way to allot money into initiatives that seek profitability but with responsibility, striking the right balance.

According to Morningstar's reports, as of the first quarter of 2025, global ESG-focused funds had approximately USD 3.16 trillion in assets under management. This is a slight decrease from the USD 3.2 trillion reported at the end of 2024. While this can be explained by the fact that the initial stages would need more money, reducing funds is perhaps not the best direction. Domestic fund houses have introduced ESG schemes, regulators are tightening disclosure rules, and investors are asking harder questions about where their money is going.

But as I see it, here’s the real shift -- ESG is no longer about doing good for people to create good impressions. It is about resilience. People’s ability to manage climate risk, treat workers fairly, or maintain good governance practices is increasingly seen as a proxy for whether they will survive and thrive in a more uncertain world.

India’s Trillion-Dollar Green Finance Test

Despite growing awareness, there appears to be the proverbial miles to go. Sustainable finance in India faces a serious supply-demand mismatch that could stall progress if not addressed head-on.

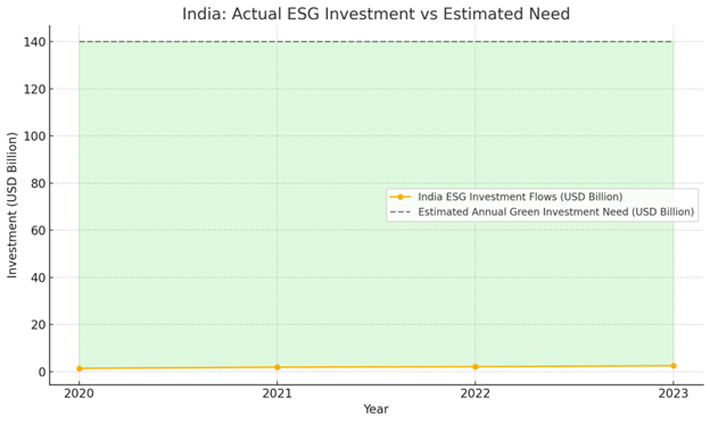

Estimates from agencies like the International Energy Agency suggest that for India to meet its net-zero targets by 2070, it needs to invest over USD 10 trillion in clean energy systems over the next five decades. That translates to roughly USD 140 billion annually, dwarfing current ESG inflows.

In contrast, ESG fund flows in India have hovered between USD 1.5-2.5 billion annually in recent years. That is a good way to begin, but it is nowhere near the scale required. The chart below shows just how wide the gap between India’s estimated annual green finance needs and actual ESG-aligned flows over the past four years is.

India: Actual ESG Investment vs Estimated Need (2020–2023

Sources: IEA, Morningstar, AMFI

One issue is the perceived risk around green projects. Many investors remain cautious, often citing unclear returns, long gestation periods, or regulatory uncertainty. Others point to a lack of project pipelines that meet international ESG standards. Sustainability experts have noted that while investor intent is high, credible, bankable projects remain in short supply.

Unless India can plug this green finance gap, with the help of innovation, incentives, and institutional support, sustainability ambitions may end up outpacing India’s ability to act.

Rooftop Solar, Ethanol & EVs – The Case for Sectoral ESG Plays

That said, there are signs of promise. Certain sectors have started attracting ESG-aligned capital and building tangible momentum on the ground.

Rooftop solar is one such example. Adoption has accelerated, especially in the commercial and industrial (C&I) segment, thanks to supportive regulations and rapidly falling costs. Forecasts suggest that India could reach 30 GW of rooftop solar capacity by FY27, driven by decarbonisation targets and cost-conscious businesses opting for clean energy.

Another sector to watch is ethanol-based biofuel. With the government pushing for higher blending ratios, grain ethanol has emerged as a strategic tool to reduce oil imports and curb emissions. Some industry studies estimate that ethanol could help India save over Rs 1.2 lakh crore in fuel costs by 2030, while also creating rural employment and reducing stubble burning.

Then there is electric mobility, which is fast evolving from a niche to a movement. Startups and legacy manufacturers alike are investing in EV infrastructure and production. At a recent industry summit, an EV company founder observed that ESG alignment now influences everything from capital raising to talent acquisition — sustainability is no longer just a checkbox; it's a core operating principle.

These sectoral stories show that when policy clarity meets business logic, ESG capital follows.

Regulation, Incentives & Investor Appetite

For ESG investing to move from momentum to maturity, it needs more than enthusiasm. It needs a strong foundation — built on rules, incentives, and trust.

One of the most significant policy moves in India has been the introduction of Business Responsibility and Sustainability Reporting (BRSR). Now mandatory for the top 1000 listed companies, BRSR aims to bring structure and comparability to ESG disclosures. It's a step in the right direction, though implementation challenges persist — especially around data quality and auditability.

Meanwhile, Production Linked Incentive (PLI) schemes for green hydrogen, solar, and batteries are helping de-risk new sectors. These incentives offer the financial cushion that makes ESG-linked investments more attractive to institutional players.

And institutions are paying attention. Global asset managers and domestic pension funds are increasingly building ESG criteria into their investment screens. In some cases, companies with stronger ESG credentials are seeing lower capital costs or faster access to funding. A recycling firm’s executive recently noted at a sustainability conclave that predictable policy and fiscal incentives play a pivotal role in investor decision-making.

Yet, retail participation in ESG remains limited. For sustainable finance to be truly inclusive, mutual fund platforms, advisors, and fintech players will need to do a better job of making these instruments accessible and understandable to everyday investors.

The Road Ahead – Aligning Capital with Climate

India’s ESG journey is still in its early chapters, but the stakes are high, and the potential is transformative. To bridge the intent-action gap, stakeholders across the board must rethink how success is measured. Short-term profits may no longer be enough; resilience, impact, and inclusivity are becoming part of the equation.

Several things must fall into place. Data must improve — not just in volume, but in quality. Financial tools must evolve — with more green bonds, blended finance, and sustainability-linked loans. And mindsets must shift — from ESG being a compliance checklist to it being embedded in corporate strategy.

Global ESG norms can guide the path, but India will need its own model, one that balances growth and equity, ambition and pragmatism. Whether it’s making clean energy affordable or turning sustainability into an economic multiplier, the answers must fit local realities.

Crucially, this isn’t just about doing good. It is about staying relevant. Companies and investors that fail to adapt may find themselves outpaced, not just by competitors, but by a changing planet and a changing consumer.

The momentum is here, and the capital is watching. Now, it’s time for Indian finance to rise to the challenge and invest in a future that is not only profitable but also worth living in.