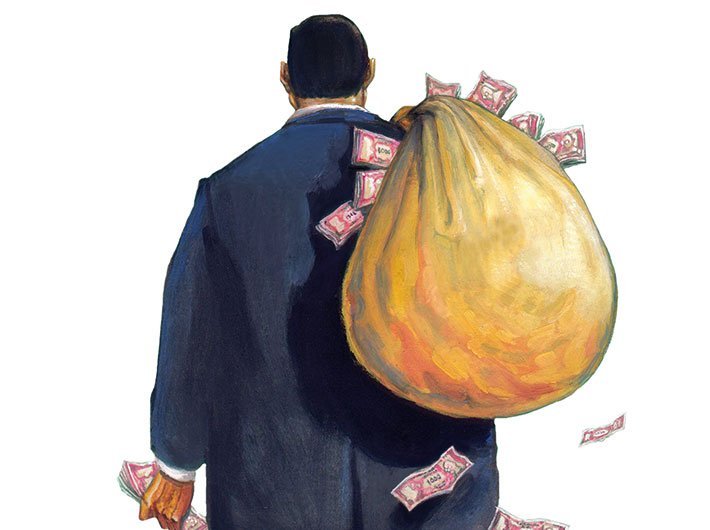

Banks are saddled with massive NPAs so RBI has provided them various tools to tackle stress in their asset portfolios

Banks have advanced a staggering Rs 29,46,060 crore to the industrial sector, of which Rs 6.93 lakh crore are non-performing assets (NPAs).

Finance minister Arun Jaitley

informed the Lok Sabha about the gross advances by Scheduled Commercial Banks (SCBs) to the industry sector as on March 31, 2017 and said that the data regarding big industrial houses is not centrally maintained.

The Reserve Bank of India has provided the banks with various tools to tackle stress in their asset portfolios. These tools include Scheme for Sustainable Structuring of Stressed Assets (S4A), Strategic Debt Restructuring Scheme (SDR), Flexible Structuring for long term project loans to Infrastructure and Core industries (5/25 Scheme), Formation of Joint Lenders’ Forum (JLF) for revitalising stressed assets in the system.

The NPAs have been steadily rising and banks are now facing a sharp haircut..

The finance minister had

informed the Lok Sabha on March 24, 2017 that as on Dec 31, 2016, Gross Non Performing Assets (GNPAs) of Scheduled Commercial Banks (SCBs) stood at Rs 6.93 lakh crore against Rs 5.66 lakh crore as on March 31, 2016.

Parliament was informed that the government has taken sector specific measures where incidence of NPA is high.

The insolvency and bankruptcy code (IBC) has been enacted and SARFAESI Act and the Recovery of Debts Due to Banks and Financial Institutions (RDDBFI) Act have been amended to improve resolution/recovery of bank loans. Six new Debt Recovery Tribunals (DRTs) have been established for improving recovery.

The advances to the industry coupled with the huge NPAs need to be juxtaposed with the RBI’s May 22, 2017

communique that said an Internal Advisory Committee focused on large stressed accounts and took up for consideration the accounts which were classified partly or wholly as non-performing from amongst the top 500 exposures in the banking system.

The IAC recommended for IBC reference all accounts with fund and non-fund based outstanding amount greater than Rs 5,000 crore, with 60 percent or more classified as non-performing by banks as of March 31, 2016. The IAC noted that under the recommended criterion, 12 accounts totaling about 25 percent of the current gross NPAs of the banking system would qualify for immediate reference under IBC.

As regards the other non-performing accounts which do not qualify under the above criteria, the IAC recommended that banks should finalise a resolution plan within six months. In cases where a viable resolution plan is not agreed upon within six months, banks should be required to file for insolvency proceedings under the IBC.

Speaking at a meeting of the consultative committee attached to the finance ministry in March, Jaitley said that to deal with the NPAs of the banks is a challenging task even though the NPAs have shown declining trend in the last quarter of the current financial year.

The core problem of NPAs is with very large corporates, though few in numbers, predominantly in the steel, power, infrastructure and textile sectors. He said that they had expanded their capacity during the boom period (2003-08) but could not face the onslaught of global financial crisis and consequent slow down thereafter, he

said.

He said that the government is taking sectoral specific measures to deal with the problem of NPAs specifically in the resolution of large debts. He added that the steel sector is on its path of recovery while many decisions have been taken in the infrastructure, power and textile sectors to resolve their problems.