Banks have an opportunity to learn from the current mess and adopt pragmatic policies

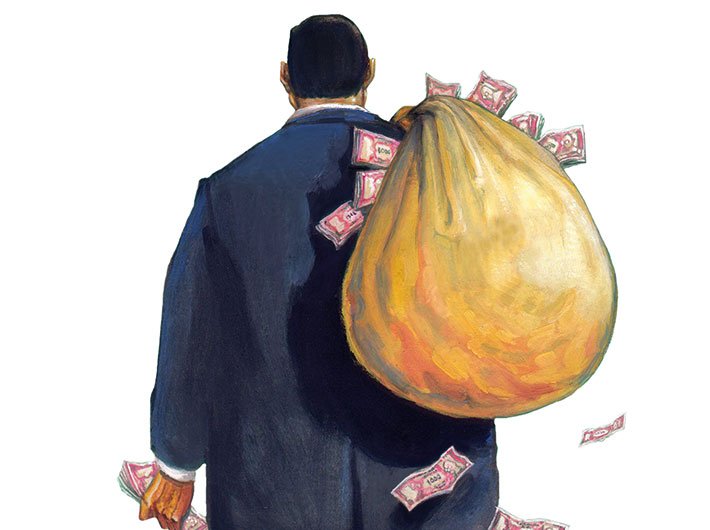

The bad loan in the name of Vijay Mallya is more than the total default on education loans in the country at a little over Rs 5,000 crore. But still his case is just a drop in the ocean of non-performing assets (NPA) worth Rs 4 lakh crore, which is more than its market evaluation. The mess that is hobbling the Indian economy is estimated to double if loans that face the risk of being declared NPAs are also taken into account.

This is not the first instance when banks are running after a business giant for recovery of loans. But it seems they have still not learnt their lessons.

The poor accountability mechanisms have reduced the banking sector, specifically the state-run banks, to weak financial institutions burdened with a huge debt of non-performing assets over the years. The NPAs of banks have increased from Rs 44,957 crore in 2009 to Rs 4 lakh crore in 2015. Easy loans to big companies, without monitoring the end use of funds, have been some of the reasons for the poor state of banks.

Pointing out the secrecy maintained in the Vijay Mallya case, S Krishnan, former additional secretary, ministry of finance, says, huge NPAs are haunting public sector banks mainly because of weak accountability and monitoring mechanisms.

“Nobody is able to see the crisis ahead. The amount will further increase.” Krishnan asks, “What sort of collateral public sector banks accept when they give loans?”

He says banks need to behave responsibly while issuing loans. “Banks knew that Kingfisher was not performing well, still he (Mallya) managed to get the loan. Rather banks bought the equity at that time.”

Highlighting how poor farmers are dealt with when they are unable to return loans, Krishnan says that at the end of the day it is the farmer who will bear the brunt of increasing bad loans. “This is when farmers have better return capacity and better record of returning than the corporates,” he adds.

Though experts believe that banks will recover only a fraction of the several thousand crores of its dues, ultimately it is the government which will have to step in. But Krishnan asks, “Should the government be spending money on development projects or bail out banks?”

Easy escape for defaulters

While banks are strict on retail borrowers, the big borrowers are able to evade the law easily. The unduly slow and long process followed by concerned authorities inadvertently gave ample time to Mallya to walk away with the funds.

A clear case of default, fund diversion and financial irregularities by Mallya took place way back in December 2011. But it was only in November 2015, when the State Bank of India (SBI) tagged him as a wilful defaulter. In March this year, SBI, which heads the consortium of 17 lenders to the Kingfisher Airlines, sought arrest of Vijay Mallya, when the bank approached the debt recovery tribunal (DRT). It sought action against him for defaulting on loans worth over Rs 7,000 crore. It was considered a strong action, but little too late. Banks filed a petition in the supreme court to ensure Mallya does not flee from the country. But the liquor baron, who probably knew about the banks moving the court, had already left the country.

It created a huge political uproar with parties blaming each other for creating an easy escape route for Mallya. But the entire story reflects how easy it is for some people in the country to manipulate things and make mockery of India’s laws and judiciary. It would be difficult for anyone to accept that the government and investigating agencies were unaware that the system was manipulated. So far, Mallya has not showed any willingness to repay. In fact, he has managed to use the judicial system to delay the repayment.

CH Venkatchalam, general secretary, All India Bank Employees’ Association (AIBEA), says that for the last 15-20 years bank unions have been cautioning and warning the managements about the bulging bad loans. But it was always brushed aside and termed as a normal phenomenon. He says authorities were aware of Mallya’s case but no action was taken against him and he continues to be a member of Rajya Sabha. He says banks need to learn lessons from this case.

“NPAs have been there in the past as well but the quantum was always limited, negligible.”

Private vs public sector banks

In comparison, the problem of bad loans of private sector banks is acute as their NPAs are only about one-eighth at about Rs 46,000 crore. This is about 6.6 percent of their total valuation.

Venkatchalam says PSU banks have additional responsibility from which they cannot shy away. PSU banks are giving loans for infrastructure projects meant for development, whereas private banks give only retail and commercial loans, where recovery is easy.

“For developing infrastructure, huge loans are taken up. PSU banks have financed many such projects, but are not getting revenues. Our money is stuck,” he says. He further adds that public sector banks are called inefficient compared to private banks. But if all the long-term industrial loans are not taken into account, PSBs will perform better than any private bank.

“Our volume [of loan issued], social orientation and risk [related to recovery of loan] are more. We cannot be compared with private sector banks,” he says.

Existing laws not enough

Before the 1990s, banks faced a hard time in recovering loans; as borrowers often filed cases in civil courts and proceedings would go on for years. To deal with this, DRTs were established in 1993 to handle NPA matters. This brought some relief but over the last few years DRTs have been bogged down by a huge number of cases. In 2002, the government also came up with the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act.

Venkatchalam says while banking reforms are being talked about, the major problem faced by banks today is of huge bad loans. “A large number of them are wilful defaulters. Existing laws are not working and they need to be more stringent. There should be stringent measures to recover the loans, however, the issue is still not taken up by the government.”

He suggests establishment of fast-track high-volume courts to deal with the mess. “Wilful default should be declared as a criminal offence and strict action should be taken. There are just five-six DRTs and they are always facing a staff crunch.”

He also says that it’s time the banks adopted the name-and-shame policy. Some of the banks have done just in March, but it might be a case of too little, too late. “Why do they hide names of wilful defaulters? Tough action must be taken against the defaulters and they should not be allowed to hold public offices.”

jasleen@governancenow.com

(The article appears in the April 1-15, 2016 issue)